Codan Limited (“ASX:CDA”, “Codan”, “Group” or “the Company”), the Australian-based technology company, today announced its full year results for the year ended 30 June 2025 (“FY25”).

Commenting on the results, Chief Executive, Alf Ianniello, said: “FY25 was a year of strong performance for Codan, and we are pleased to report that we achieved significant growth across the Group. In an environment of ongoing global uncertainty, our teams executed on their plans with focus, delivering improved revenue, earnings and cash generation. These results are a testament to our strategy and our continued investment in innovation, capability and customer relationships. With our disciplined approach and a strengthened balance sheet, Codan is well positioned to pursue future opportunities from a position of confidence.

As we look ahead, we remain committed to building a stronger Codan - investing in innovation, broadening our capabilities, and delivering long-term value to our shareholders.”

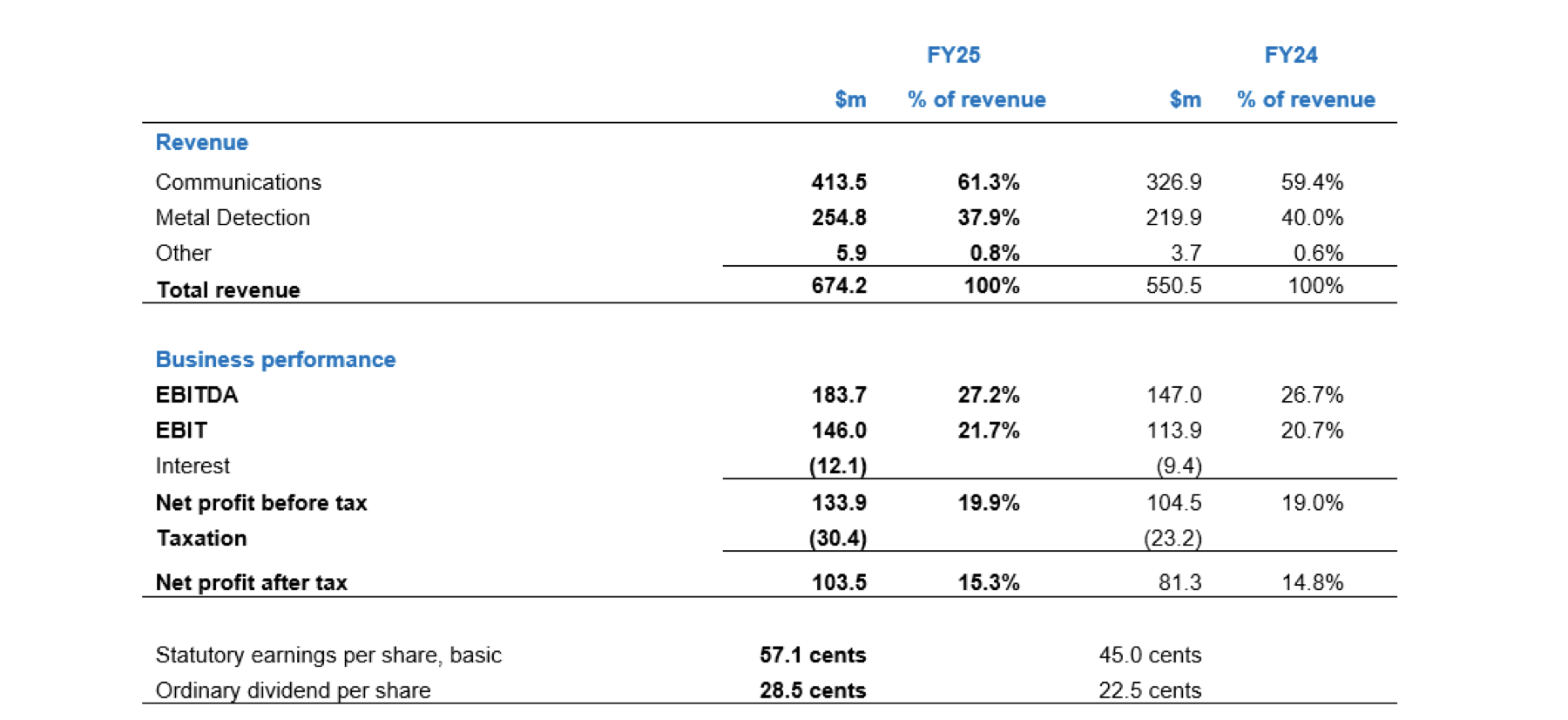

At a Group level, year-on-year revenue grew 22%, reflecting strong organic growth, supplemented by recently acquired Kägwerks. All key profitability metrics improved on FY24, with EBIT and NPAT increasingby 28% and 27% respectively. Notably, these profit metrics are after expensing approximately $5 million(pre-tax) of non-recurring acquisition pursuit and due diligence costs, including the acquisition of Kägwerks and other opportunities that were meaningfully evaluated, but not pursued during the financial year,consistent with Codan’s strategic objectives.

Net debt reduced $45.8 million to $78.3 million as at 30 June 2025, down from $124.1 million at 31 December 2024. This reduction reflects strong second half cash generation and working capital management.

Subsequent to year-end, Codan has increased and extended its existing bank facility to $250 million (from $170 million), with a further $150 million in accordion capacity available subject to bank approval. The facility now matures in September 2028. These facilities provide Codan with further financial flexibility to pursue future inorganic growth initiatives. The Company continues to assess acquisitions that enhance the quality and predictability of Group revenues, with a primary focus on opportunities in Communications markets that complement our technology, accelerate our product roadmaps, or extend our customer portfolio as well as providing longer-term earnings visibility.

Communications (DTC & Zetron)

Codan Communications designs and manufactures mission-critical communication solutions for global military, public safety and commercial applications. These solutions allow customers to save lives, enhance security and productivity, and support peacekeeping activities worldwide.

In FY25, Communications’ revenue grew 26% to $413.5 million, driven primarily by organic growth of 19%,well above the targeted 10 to 15% range. Revenue from defence customers now represents 38% of total Communications revenue, and this vertical is a key long-term target market. Communications’ segment profit increased by 34% to $107.9 million whilst segment profit margins (excluding Kägwerks) expanded to 27%, up from 25% in the pcp, reflecting operating leverage as the business continues to scale. The Company remains focused on achieving additional operating leverage, targeting a 30% segment profit margin in the Communications segment by the end of FY27, while continuing to invest in product development to support long-term growth.

Communications’ orderbook grew to $253 million as at 30 June 2025 (+28% versus 30 June 2024),providing a solid foundation heading into FY26.

DTC, formerly Tactical Communications, delivered an exceptionally strong result in FY25, underpinned by growing global defence expenditure - particularly in unmanned systems - and continued momentum in law enforcement verticals. The business continues to benefit from its leading MESH radio technology and solutions, which offers robust, high-performance communications in harsh and contested environments. DTC’s compact, lightweight and power-efficient solutions remain well-suited to mission-critical use cases where size, weight and power are critical to operational performance. This is particularly relevant in unmanned systems, where DTC delivered approximately $100 million in revenue during FY25, more than doubling prior year’s result. As global defence budgets increase, DTC’s presence in the UK, US and Australia provides a strategic advantage in capturing long-term communications programs across North America, the Five Eyes alliance, and other NATO-aligned markets. We have a strong pipeline of opportunities, underpinning our continuing investment in the DTC communications platform.

In December 2024, Codan acquired Kägwerks, a U.S. based leader in operator-worn communications systems. Kägwerks provides lightweight, soldier-worn network DOCK that integrate multiple tactical technologies into a single, user-friendly platform. This acquisition has strengthened Codan’s position in

the global military communications market by expanding its presence in the U.S. defence ecosystem and providing access to the funded Nett Warrior Program of Record. In line with our acquisition expectations, Kägwerks delivered $24 million in revenue in our 7 months of ownership in FY25. Initially, the timing of revenues will be dependent on the Nett Warrior Program. Integration activities are focused on broadening the Kägwerks sales teams to enable expansion into DTC’s broader customer base across North America and in particular international markets.

Zetron’s EMEA and Asia Pacific business grew strongly in FY25, delivering growth within our targeted 10 to 15% range. Key highlights include a 10-year, $14 million nationwide public safety contract in Australasia, alongside several smaller wins - such as ACOM adoption by a major UK airline and a CallTouch deployment on a key rail corridor linking London to South Wales. In the U.S. market, growth was adversely impacted by ongoing government reviews and delays in funding for government-funded agency opportunities, which moderated 2H performance and near-term momentum. Despite this, Zetron recently secured a 10-year, $19 million contract with one of the largest utilities on the U.S. East Coast, servicing 3.3 million customers. The business continues its focus on innovation and customer-driven solutions, with ongoing R&D investment advancing command and control capabilities and product suite upgrades to deliver seamless, integrated user experiences.

In summary, Communications remains well-positioned for growth, supported by ongoing investment in business development and engineering capabilities.

Metal Detection (Minelab)

Minelab is the world leader in the handheld metal detection industry for recreational, gold prospecting,demining and military markets. Over the past 30 years Minelab has led the category in innovation and hasdriven metal detection performance to new levels of technological excellence.

Minelab achieved full-year revenue of $254.8 million, an increase of 16% versus the pcp. Pleasingly,segment profit margin increased to 39%, up from 35%, driven by benefits of scale, supported by a revenue mix of higher margin products – particularly from a higher proportion of gold detector products sold.

Minelab Africa delivered a strong full-year performance, with revenue of approximately $115 million, up both year-on-year and half-on-half by 64% and 54% respectively. This result reflects demand from across the region (excluding Sudan), underpinned by business development initiatives to grow our presence across new and existing markets. While Codan has not historically directly linked gold detector demand to movements in the gold price, the currently elevated gold price appears to be providing supportive demand conditions in key artisanal markets.

Minelab recently soft-launched Gold Monster 2000, a new gold detector retailing at approximately twice the price of the Gold Monster 1000. Positioned as a premium entry-level product, it will be released to customers in Q1 FY26 and is expected to contribute to growth in FY26.

Minelab’s Rest of World (RoW) business maintained revenue versus the pcp, which we consider to be a good outcome in what remains quite challenging consumer conditions. This success reflects our focus on growing physical and e-commerce distribution channels and capitalising on Minelab’s brand dominance in many markets. Minelab continues to invest in growing market share through the ongoing investment in its product roadmaps, new technology platforms, expansion of its retail footprint in the US and Europe, and enhancement of its e-commerce capabilities. These initiatives are expected to support future growth as four new products are scheduled for release in FY26.

The moderation of humanitarian aid by the U.S. Government Administration resulted in lower sales of Minelab’s Countermine products in FY25. In response, the business is undergoing a strategic shift to re-position towards more military-based applications, for which there is a growing need.

Summary

The Group continues to deliver on the strategy of building a stronger Codan. Our strategic pillars of investing in intellectual property, product R&D, people and systems, expanding into new geographies and strengthening Codan’s position in core markets, and disciplined capital allocation will continue to guide our focus in FY26. As part of this strategy, Codan actively evaluates acquisition opportunities for the Communications business that align with its technology platforms and strategic market priorities.

Looking ahead to FY26, the Communications business targets long-term sales growth of at least 10 to 15% per annum and, as demonstrated in FY24 and FY25, this target growth range can be exceeded.

With approximately $155 million of FY26 revenue already secured in the 30 June orderbook, the expectation of increased defence spending by governments, the ongoing growth in the unmanned systems market and the first full year of contribution from Kägwerks, our Communications business is well positioned to grow in the 15 to 20% range in FY26.

Minelab enters FY26 in a strong position, building on the momentum of excellent growth delivered in FY25. As the global leader in hand-held metal detection, Minelab continues to benefit from its market leadership, well-recognised brand, and global distribution footprint. FY26 is shaping up to be an exciting year with four new product releases scheduled across the recreational, gold, and countermine product ranges. These launches, combined with favourable macro conditions in key regions such as West Africa, position the business to capture further demand and deliver continued growth.

Codan is well positioned for sustained growth and, supported by current favourable market conditions for our defence related communications products and our gold detectors, we expect to continue to grow the revenue and profitability of our high-performing businesses and deliver long-term value to shareholders.

With a strong balance sheet and a disciplined approach to capital allocation, the Group remains well placed to execute on strategic acquisitions. The recently renewed $250 million debt facility provides increased flexibility and funding capacity to support future inorganic growth initiatives.

The Board will provide a further business update at the Annual General Meeting on 22 October 2025.