Motorola Solutions, Inc. (NYSE: MSI) today reported its earnings results for the first quarter of 2024.

“Q1 was an outstanding quarter, with record Q1 revenue in both segments and record Q1 cash flow,” said Greg Brown, chairman and CEO, Motorola Solutions. “Our continued robust backlog and strong balance sheet position us well going forward. As a result, we’re raising both our revenue and earnings expectations for the full year.”

OTHER SELECTED FINANCIAL RESULTS

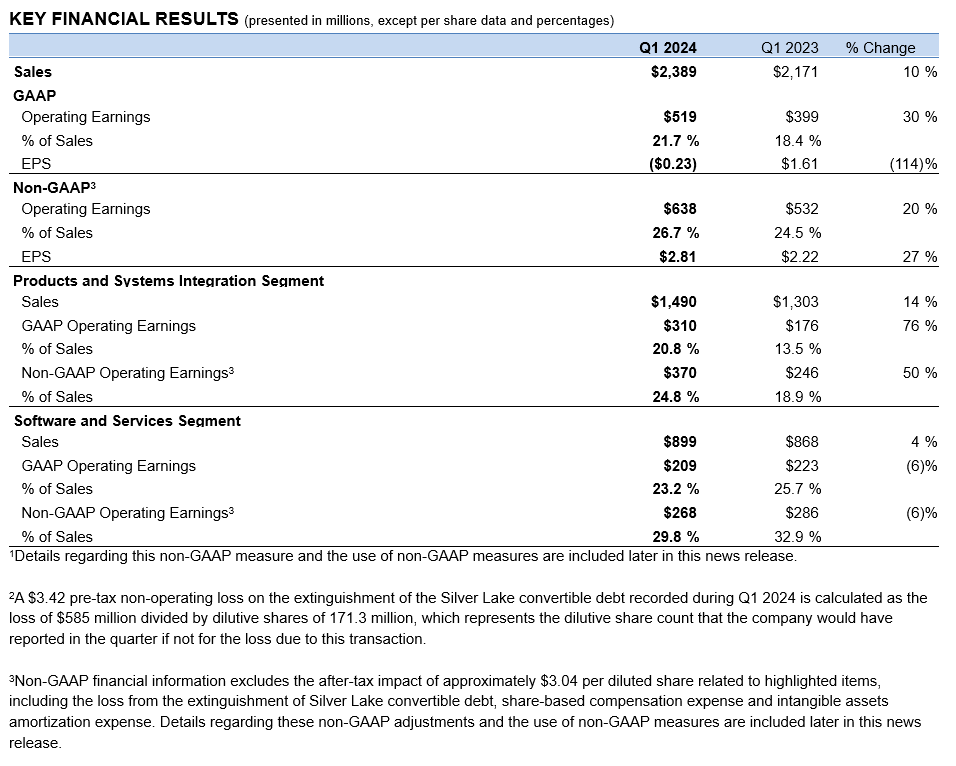

Revenue - Sales were $2.4 billion, up 10% from the year-ago quarter driven by growth in North America and International. Revenue from acquisitions was $10 million and currency tailwinds were $1 million in the quarter. The Products and Systems Integration segment grew 14%, driven by growth in land mobile radio communications ("LMR") and video security and access control ("Video"). The Software and Services segment grew 4%, driven by growth in Video and Command Center, partially offset by lower revenue in the U.K. related to the CMA's decision to implement a prospective price control on Airwave (the "Charge Control") and our exit from the Emergency Services Network ("ESN") contract.

Operating margin - GAAP operating margin was 21.7% of sales, up from 18.4% in the year-ago quarter. Non-GAAP operating margin was 26.7% of sales, up 220 basis points from 24.5% in the year-ago quarter. The increase in both GAAP and Non-GAAP operating margin was driven by higher sales, favorable mix and improved operating leverage, partially offset by the Charge Control.

Taxes - The GAAP effective tax rate during the quarter was 57.8%, driven by the non deductible loss on the extinguishment of Silver Lake convertible debt, offset by utilization of foreign tax credit carryovers. This compares to a tax rate of 22.1% in the year-ago quarter. The non-GAAP effective tax rate was 22.1%, compared to 21.9% in the year-ago quarter.

Cash flow - Operating cash flow was $382 million, compared to a usage of $8 million in the year-ago quarter and free cash flow was $336 million compared to a usage of $62 million in the year-ago quarter. Both the operating cash flow and free cash flow for the quarter increased primarily due to improved working capital and higher earnings, net of non-cash charges.

Capital allocation - During the quarter, the company paid $163 million in cash dividends, incurred $46 million of capital expenditures and repurchased $39 million of common stock. Additionally, the company settled the Silver Lake convertible debt for $1.59 billion in cash, inclusive of the conversion premium, resulting in an overall reduction in the company's diluted share count and eliminating any further share dilution related to the note. The company received credit rating upgrades to BBB from both S&P and Fitch, issued $1.3 billion in long-term debt during the quarter, and closed the acquisition of Silent Sentinel, a provider of specialized long-range cameras, for $37 million, net of cash acquired.

Backlog - The company ended the quarter with record backlog of $14.4 billion, up 2% or $331 million from the year-ago quarter. Products and Systems Integration segment backlog was down $74 million, or 2%, driven primarily by unfavorable foreign exchange rates. Software and Services segment backlog was up $404 million, or 4%, driven by increases in multi-year software and services contracts in both regions.

NOTABLE WINS AND ACHIEVEMENTS

Software and Services

$25M LMR services order for Douglas County, Colorado

$25M LMR services order for U.K. Department of Health

$18M Command Center order for San Francisco

$14M LMR services order for Lithuania

$11M LMR services order for São Paulo State Police, Brazil

Products and Systems Integration

$22M P25 device order for large U.S. customer

$16M LMR order for an international customer

$13M LMR order for State of Tennessee

$13M mobile video order for North Carolina State Highway Patrol

BUSINESS OUTLOOK

Second quarter 2024 - The company expects revenue growth between 7% and 8% compared to the second quarter of 2023. The company expects non-GAAP EPS in the range of $2.97 to $3.02 per share. This assumes approximately 170 million fully diluted shares and a non-GAAP effective tax rate of approximately 24%.

Full-year 2024 - The company now expects revenue growth of approximately 7%, up from its prior guidance of approximately 6%, and non-GAAP EPS of between $12.98 and $13.08 per share, up from its prior guidance of between $12.62 and $12.72 per share. This outlook assumes approximately $30 million of foreign exchange headwinds, a fully diluted share count between 170 million and 171 million shares and a non-GAAP effective tax rate between 23% and 24%.

The company has not quantitatively reconciled its guidance for forward-looking non-GAAP metrics to their most comparable GAAP measures because the company does not provide specific guidance for the various reconciling items as certain items that impact these measures have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, a reconciliation to the most comparable GAAP financial metric is not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results.

RECENT EVENTS

U.K. HOME OFFICE UPDATE

In October 2021, the Competition and Markets Authority ("CMA") opened a market investigation into the Mobile Radio Network Services market. This investigation included Airwave, the company's private mobile radio communications network that it acquired in 2016. Airwave provides mission-critical voice and data communications to emergency services and other agencies in Great Britain.

In 2023, the CMA imposed a legal order on Airwave which implemented the Charge Control. After the Competition Appeal Tribunal ("CAT") dismissed the company's appeal of the CMA's final decision on December 22, 2023, the company filed an application with the United Kingdom Court of Appeal on February 13, 2024, requesting that it hear the company's appeal of the CAT judgment; the Court of Appeal has not yet responded to this request. Since August 1, 2023, revenue under the Airwave contract has been recognized in accordance with the Charge Control, and will continue to be unless the United Kingdom Court of Appeal were to reverse the CAT's judgment and overturn the Charge Control.

On March 13, 2024, the company received a notice of contract extension (the “Deferred National Shutdown Notice”) from the U.K. Home Office. The Deferred National Shutdown Notice extends the “national shutdown target date” of the Airwave service from December 31, 2026 to December 31, 2029, at the Charge Control rates.

The company's backlog for Airwave services contracted with the U.K. Home Office through December 31, 2026 was previously reduced by $777 million to align with the Charge Control. In the first quarter of 2024, as a result of the U.K. Home Office's notice of a contract extension pursuant to their Deferred National Shutdown Notice, the company has recorded additional backlog of $748 million to reflect the incremental three years of services. On April 11, 2024, the company filed proceedings in the U.K. High Court challenging the decision of the U.K. Home Office to issue the Deferred National Shutdown Notice as being in breach of applicable U.K. procurement and public law. The backlog related to the incremental years of service contemplated in the Deferred National Shutdown Notice could change depending on the outcome of the proceedings.

To continue read the full results